September 26, 2023

Vegas and Phoenix Cross Market Insights Report - September 2023

We recently released our latest Market Insights report for the Vegas and Phoenix markets for September 2023. Here is a high level overview of our findings.

- From Q4 2022 to Q3 2023, active listings saw a sharp decline in both Vegas and Phoenix. However, there was a noticeable uptick in active listings last month. Additionally, both markets experienced an increase in new listings during the same period, even as closings fluctuate on a monthly basis.

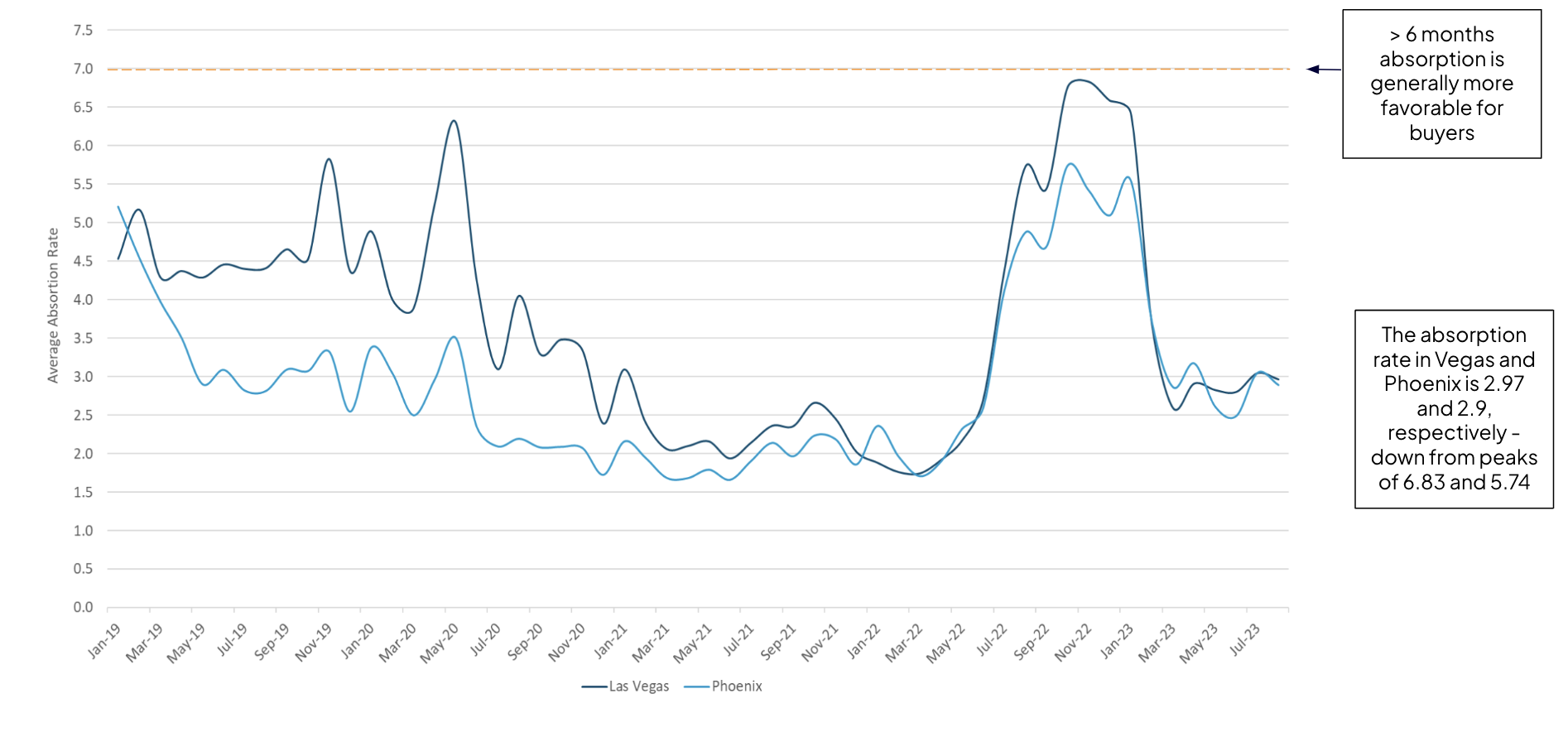

- Absorption rates have seen significant declines from their peaks in late 2022 and early 2023. Currently, the absorption rates stand at 2.97 months in Vegas and 2.9 months in Phoenix.

- Since peaking in May 2022, institutional-grade home prices have dropped by nearly 5% in Vegas and 4% in Phoenix.

- In Q4 2022, approximately 80% of all properties in Las Vegas and Phoenix had been on the market for over 60 days. Presently, properties with 60+ DOM make up just 43% in Vegas and 41% in Phoenix.

- After reaching a low in Q4 2022, the sale-to-original-list pricing in both Vegas and Phoenix has rebounded to 98%.

- Average list prices and sale prices p.s.f have converged in both both markets. In Vegas, this convergence is attributed to rising average sale prices p.s.f., whereas in Phoenix, it's because of a decline in average list prices p.s.f.

- Amid rising mortgage rates, these two MSAs continue to rank among the least affordable in the nation.

Interested in learning more about Entera and our Market Insights reports?

Click here to request a consultation with our experts.

.png)